What modern philanthropy tells us – and why it matters here in Sussex

The latest research from The Beacon Collaborative and Barclays Private Bank makes for really interesting reading – shining some light (and some hard data!) on how people with significant resources are choosing to give, what motivates them, and what kind of support they need to maximise the impact of their giving.

Giving is growing - but donors want clarity and confidence

The research backs up what those of us in the philanthropy sector already know – there is a huge amount of generosity in our country, with 93% of the UK’s wealthiest individuals already giving to charity and contributing an estimated £11.4 billion in 2024. Yet the research also shows that many of these donors lack access to trusted, knowledgeable advice on how to give effectively and efficiently. For us at Sussex Community Foundation, this reinforces something we hear often: people want to help, but they don’t always know where their support will make the biggest difference.

Supporting philanthropy in Sussex

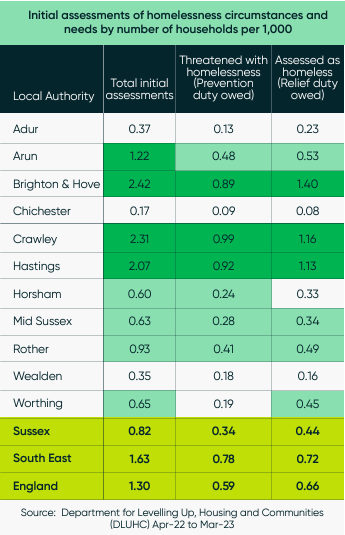

Here in Sussex, we’re proud to play a role as a local philanthropic partner. We help donors give with confidence that their resources are reaching grassroots organisations that are doing vital work – whether they are local food banks, mentoring for disadvantaged young people, singing groups which combat loneliness for older people, or providing vital support for disabled adults. We are in constant dialogue with people running local community groups, gathering insights to share with donors, so their giving is purposeful, not just well-intentioned. And we use the latest data, like our Sussex Uncovered reports, to highlight where the need is greatest.

The role of professional advisors

Recent research from CAF, The Philanthropy Advantage, also shows that up to two-thirds of high-net-worth (HNW) giving happens without financial advice, and only around a third of HNW donors have talked about the tax efficiency of their giving in the past two years. This suggests that a significant portion of charitable giving could be even more effective with the right guidance.

Advisors play a crucial role. 81% of wealthy donors believe professional advisors should proactively raise philanthropy as part of wider financial planning. It’s encouraging to see this recognised, because values-led giving isn’t separate from the decisions people make about their wealth – it’s often central to them.

That’s why the Foundation invests so much time in working with financial planners, solicitors and accountants across Sussex. We help advisors introduce their clients to meaningful, place-based giving opportunities, whether that’s through a legacy, a Donor Advised Fund, or long-term endowment giving. Over the last few years, we’ve seen this network grow significantly. Advisors tell us they value having a trusted, local partner they can turn to, and donors tell us they value the opportunity to invest in the place they call home.

A hopeful future for giving

The most hopeful message in the research is this: people want their giving to be more thoughtful, more strategic and more connected to their values. And they are looking for guidance. That presents a huge opportunity, not just for donors and advisors, but for communities across Sussex.

Connecting people and place

At the Foundation, we’ll continue to bring inspirational people together to create the change Sussex needs. If you’re an advisor who’d like to understand more about how we can support your conversations with clients, we’d love to speak with you. The more we connect people who want to help with the organisations delivering real change, the stronger our county becomes.